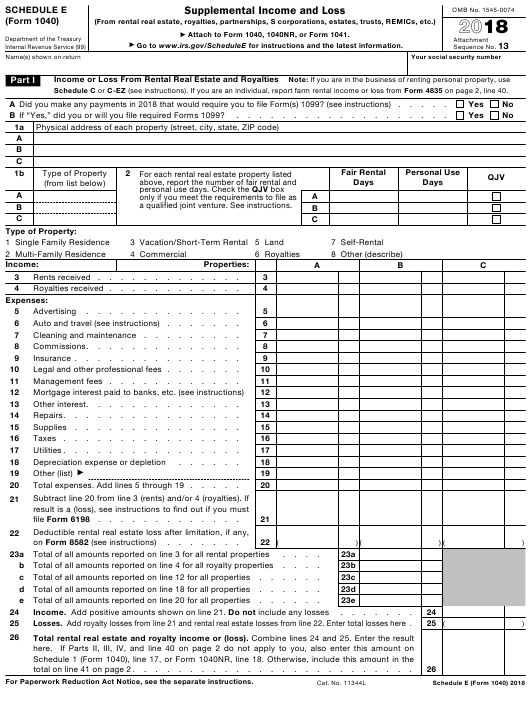

The IRS Form 1040 Schedule E is an essential document for taxpayers who earn rental income or have any other type of income not directly related to employment. It allows taxpayers to report their supplemental income and deduct any associated expenses, such as mortgage interest, repairs, and property taxes. By using this form, taxpayers can ensure that they are accurately reporting their rental income and taking advantage of all applicable deductions.

IRS Form 1040 Schedule E – Download Fillable PDF

Download the fillable PDF version of the IRS Form 1040 Schedule E, which allows you to easily fill out and submit your rental income information. This form is available for free on the IRS website and can be accessed by taxpayers who need to report their rental income.

Download the fillable PDF version of the IRS Form 1040 Schedule E, which allows you to easily fill out and submit your rental income information. This form is available for free on the IRS website and can be accessed by taxpayers who need to report their rental income.

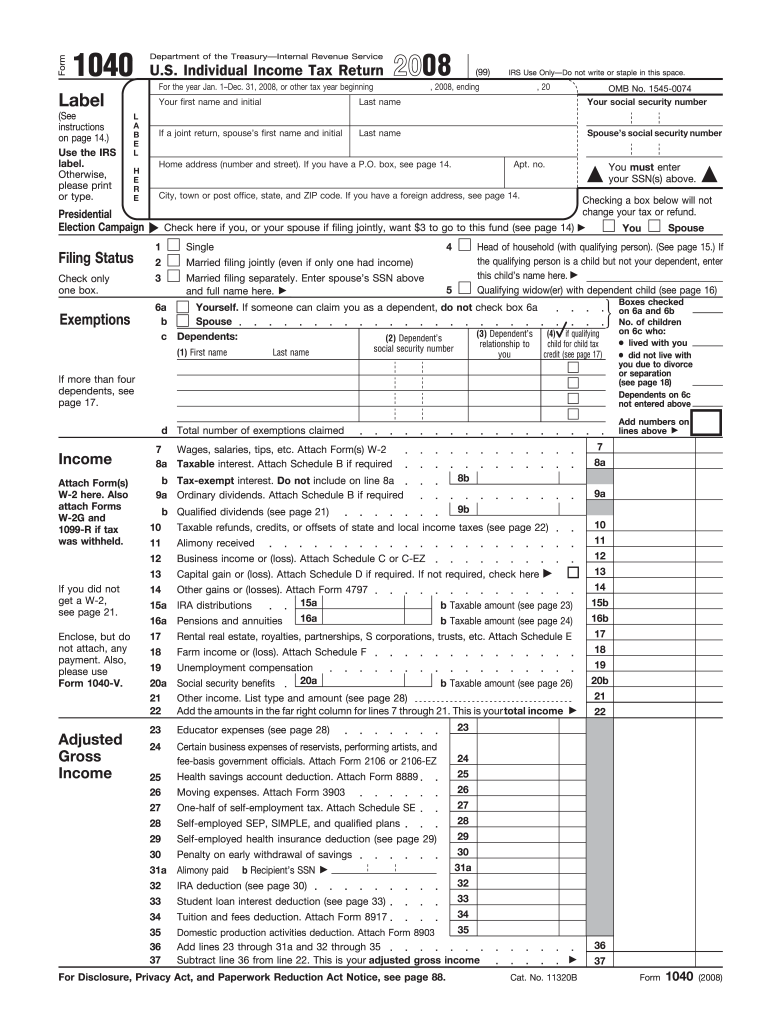

2008 Form IRS 1040 – Fill Online Printable Fillable Blank

If you need to fill out the 2008 Form IRS 1040, you can easily do so online using the fillable and printable blank version of the form. This option provides convenience and ease of use for taxpayers who may not have access to physical copies of the form.

If you need to fill out the 2008 Form IRS 1040, you can easily do so online using the fillable and printable blank version of the form. This option provides convenience and ease of use for taxpayers who may not have access to physical copies of the form.

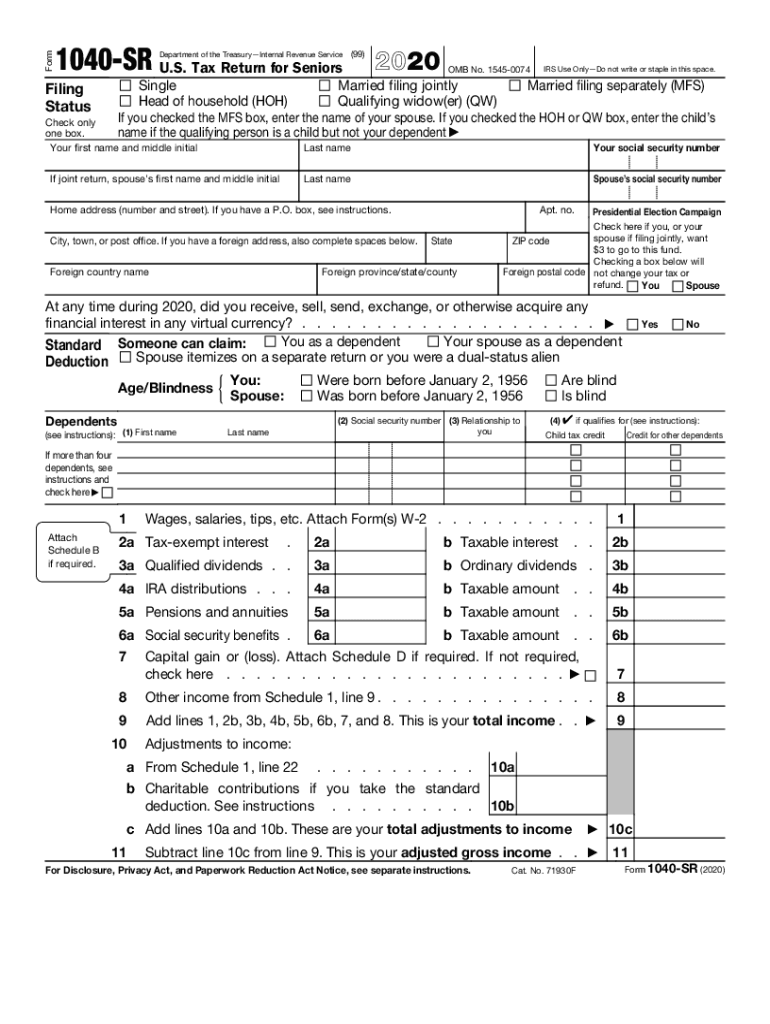

2020 Form IRS 1040-SR – Fill Online, Printable, Fillable, Blank

For taxpayers who are 65 or older, the 2020 Form IRS 1040-SR is specifically designed to accommodate their needs. This form is fillable, printable, and can be completed online, making it more accessible and convenient for older taxpayers.

For taxpayers who are 65 or older, the 2020 Form IRS 1040-SR is specifically designed to accommodate their needs. This form is fillable, printable, and can be completed online, making it more accessible and convenient for older taxpayers.

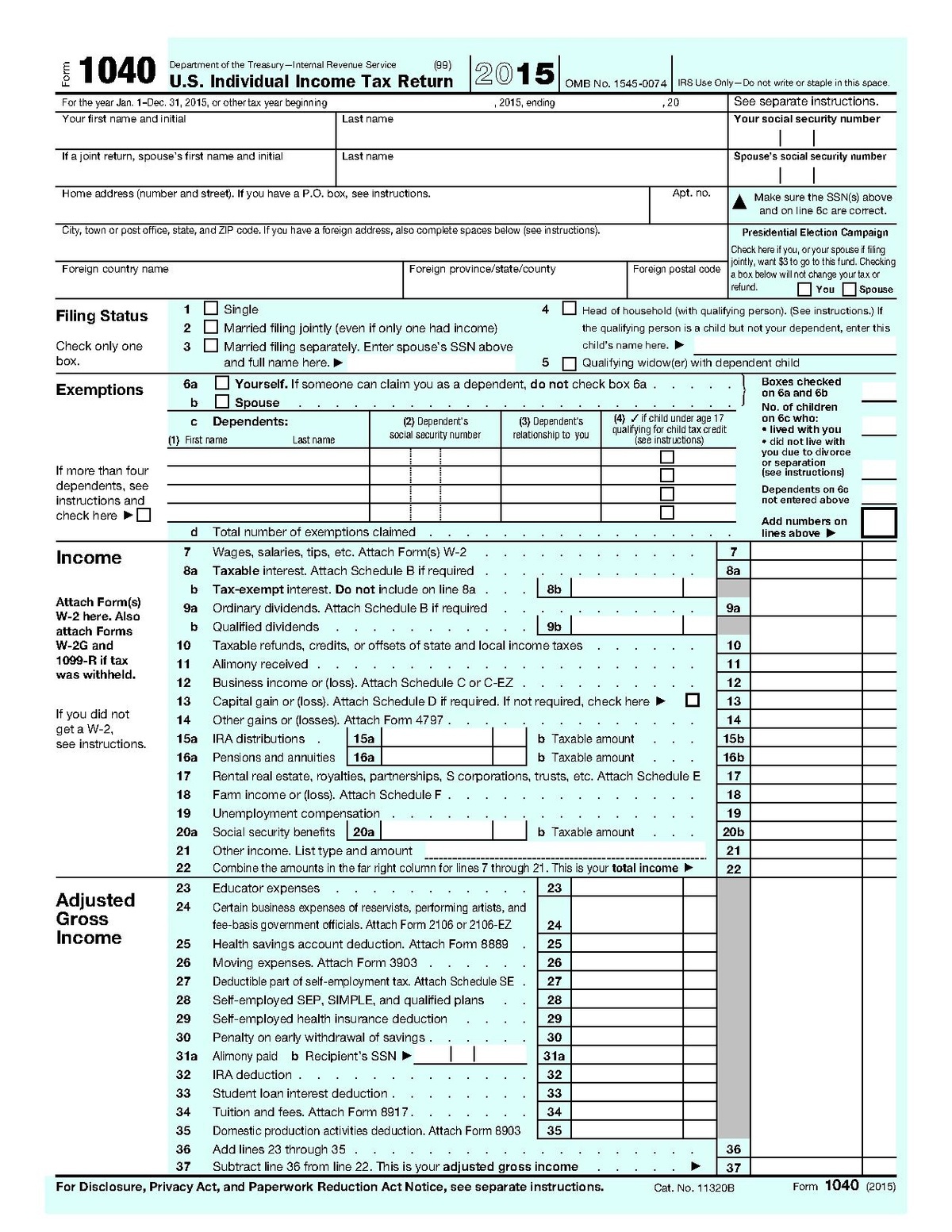

2015 Form IRS Instruction 1040 EZ – Fill Online Printable

The 2015 Form IRS Instruction 1040 EZ is a simplified version of the main Form 1040. It is specifically designed for taxpayers with straightforward tax situations and who meet certain income requirements. This form is fillable and printable, making it easy for taxpayers to report their income.

The 2015 Form IRS Instruction 1040 EZ is a simplified version of the main Form 1040. It is specifically designed for taxpayers with straightforward tax situations and who meet certain income requirements. This form is fillable and printable, making it easy for taxpayers to report their income.

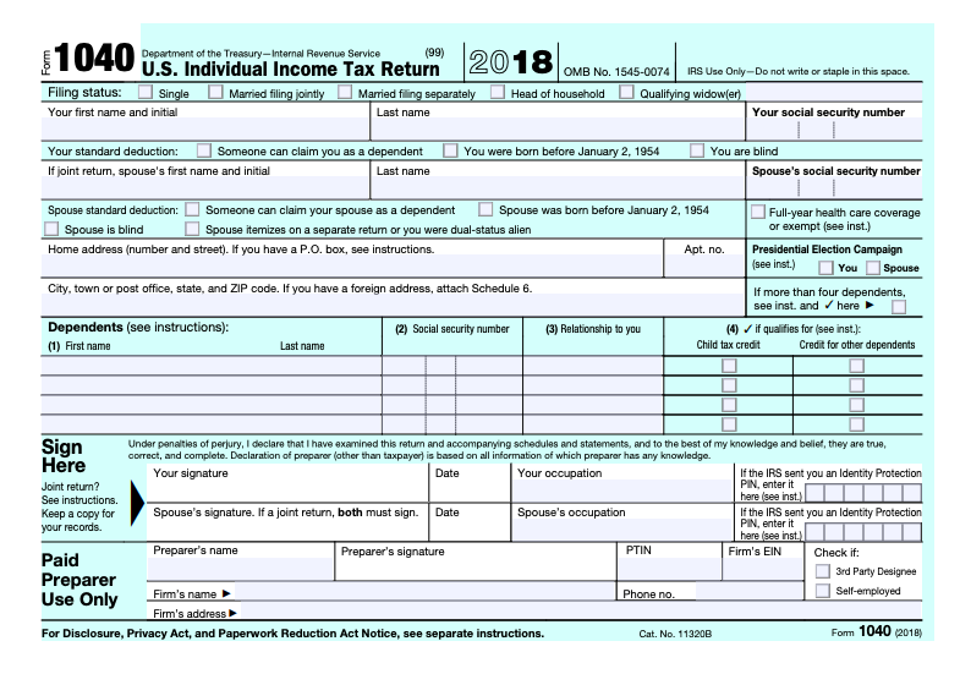

IRS Releases New Not-Quite-Postcard-Sized Form 1040 For 2018

In 2018, the IRS released a new version of Form 1040 that was designed to be smaller in size than previous versions. Although it was initially referred to as a “postcard-sized” form, it is slightly larger than a typical postcard. This new design was aimed at simplifying the tax filing process for taxpayers and reducing the complexity of the form.

In 2018, the IRS released a new version of Form 1040 that was designed to be smaller in size than previous versions. Although it was initially referred to as a “postcard-sized” form, it is slightly larger than a typical postcard. This new design was aimed at simplifying the tax filing process for taxpayers and reducing the complexity of the form.

1040 (2018) – Internal Revenue Service - Free Printable IRS 1040 Forms

The 1040 (2018) form is the main individual income tax return form used by taxpayers. This form is available for free on the Internal Revenue Service (IRS) website and can be easily downloaded and printed. It includes detailed sections for reporting various types of income, deductions, and credits.

The 1040 (2018) form is the main individual income tax return form used by taxpayers. This form is available for free on the Internal Revenue Service (IRS) website and can be easily downloaded and printed. It includes detailed sections for reporting various types of income, deductions, and credits.

Form 1040 U.S. Individual Income Tax Return

The Form 1040 U.S. Individual Income Tax Return is the primary form used by individuals to report their annual income and calculate their tax liability. This form provides a comprehensive overview of a taxpayer’s income, deductions, and tax credits, allowing them to determine their final tax liability or refund amount.

The Form 1040 U.S. Individual Income Tax Return is the primary form used by individuals to report their annual income and calculate their tax liability. This form provides a comprehensive overview of a taxpayer’s income, deductions, and tax credits, allowing them to determine their final tax liability or refund amount.

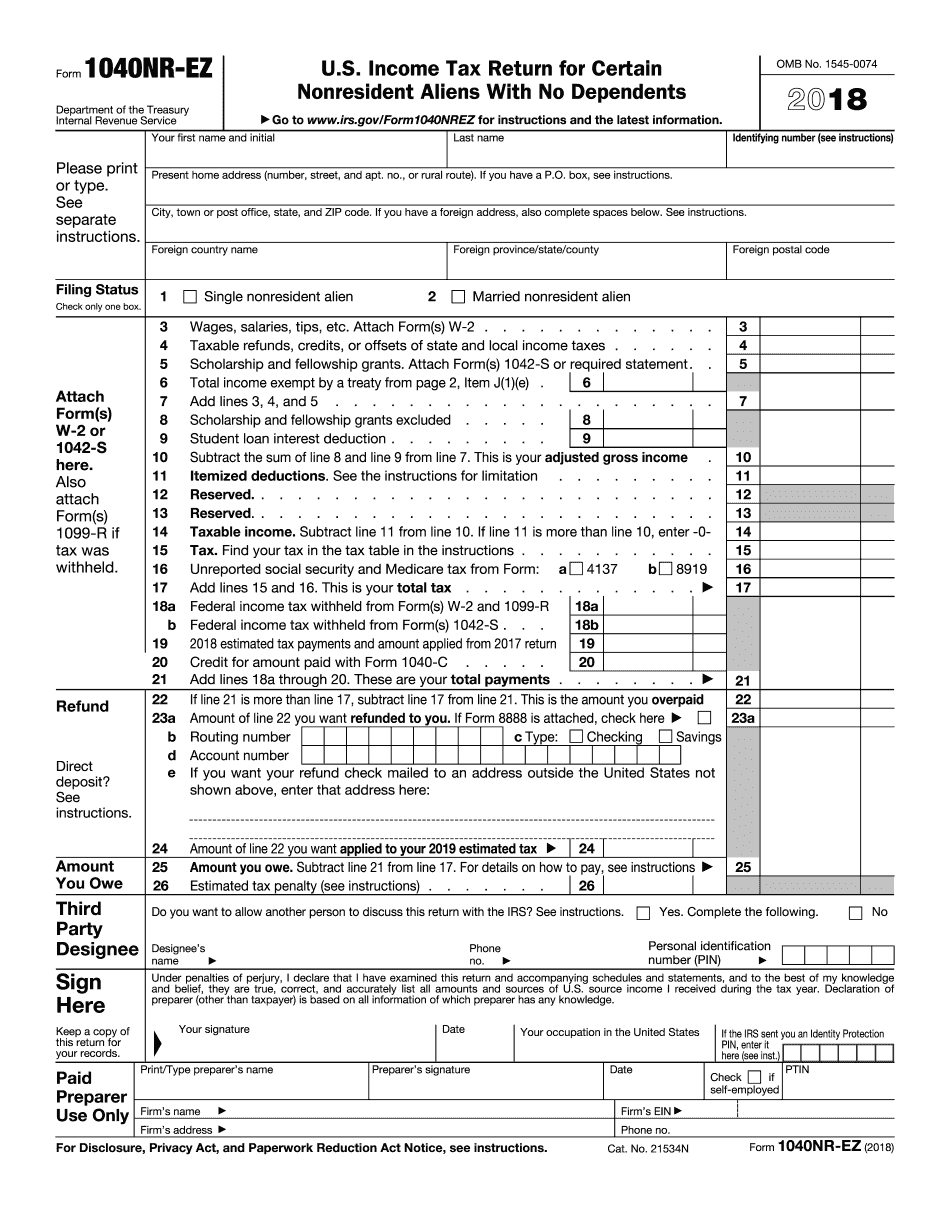

IRS Form 1040-NR – Printable PDF

If you are a non-resident alien who has earned income in the United States, you may be required to file the IRS Form 1040-NR. This form is specifically designed for non-residents and provides a comprehensive overview of their U.S. income and tax liability. The form is available in printable PDF format for ease of use.

If you are a non-resident alien who has earned income in the United States, you may be required to file the IRS Form 1040-NR. This form is specifically designed for non-residents and provides a comprehensive overview of their U.S. income and tax liability. The form is available in printable PDF format for ease of use.

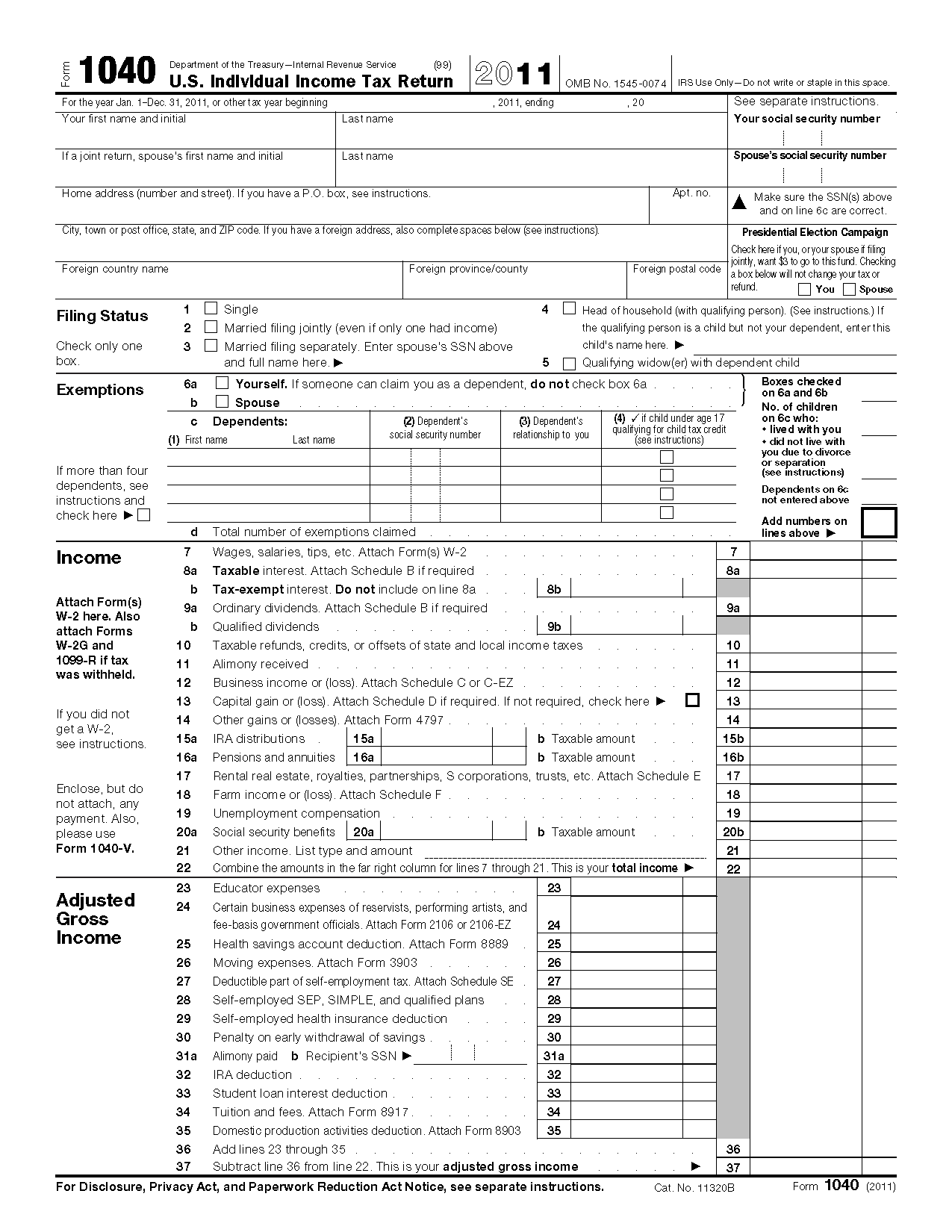

Form 1040 2016

The Form 1040 for the year 2016 is an older version of the main individual income tax return form. It includes sections for reporting various types of income, deductions, and tax credits. While this form is no longer in use, it can still serve as a reference for taxpayers who need to understand the format and structure of previous versions of the form.

The Form 1040 for the year 2016 is an older version of the main individual income tax return form. It includes sections for reporting various types of income, deductions, and tax credits. While this form is no longer in use, it can still serve as a reference for taxpayers who need to understand the format and structure of previous versions of the form.

Electronic IRS Form 1040 NR EZ – Printable PDF

The electronic IRS Form 1040 NR EZ is specifically designed for non-resident aliens who have simple tax situations. This form is available in a printable PDF format and can be easily completed by non-residents who need to report their U.S. income and determine their tax liability.

The electronic IRS Form 1040 NR EZ is specifically designed for non-resident aliens who have simple tax situations. This form is available in a printable PDF format and can be easily completed by non-residents who need to report their U.S. income and determine their tax liability.

These various forms, such as the IRS Form 1040 Schedule E and Form 1040 U.S. Individual Income Tax Return, play a crucial role in ensuring that taxpayers accurately report their income and claim all applicable deductions. By utilizing these forms and following the instructions provided, taxpayers can simplify the tax filing process and avoid any potential errors or penalties.