Hey everyone, today I want to talk about an important tax form called the W-9. It's a crucial document that is used in the United States for tax purposes, and I thought it would be helpful to provide some information about it. So, let's get started!

A W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is a document that businesses use to collect taxpayer information. It is mainly used to report income paid to independent contractors, freelancers, or other non-employees. If you receive income from multiple sources, you may be required to fill out separate W-9 forms for each payer.

A W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is a document that businesses use to collect taxpayer information. It is mainly used to report income paid to independent contractors, freelancers, or other non-employees. If you receive income from multiple sources, you may be required to fill out separate W-9 forms for each payer.

Why is it Important?

The W-9 form is essential for two primary reasons. Firstly, it provides the payer with the necessary information to prepare and submit an accurate 1099-MISC form, which reports the income paid to you. Secondly, it helps the Internal Revenue Service (IRS) to verify the recipient’s taxpayer identification number (TIN) and prevent fraud.

The W-9 form is essential for two primary reasons. Firstly, it provides the payer with the necessary information to prepare and submit an accurate 1099-MISC form, which reports the income paid to you. Secondly, it helps the Internal Revenue Service (IRS) to verify the recipient’s taxpayer identification number (TIN) and prevent fraud.

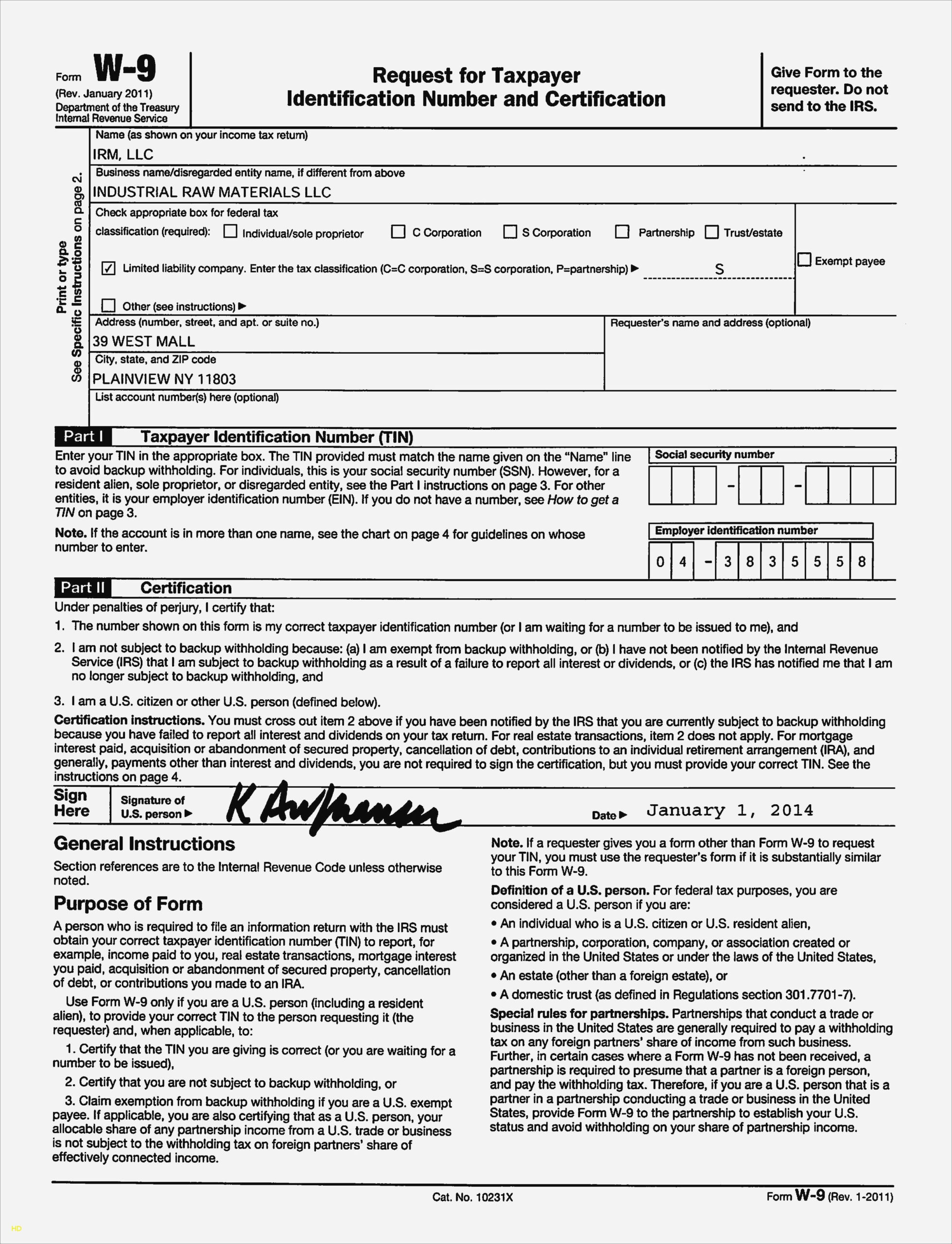

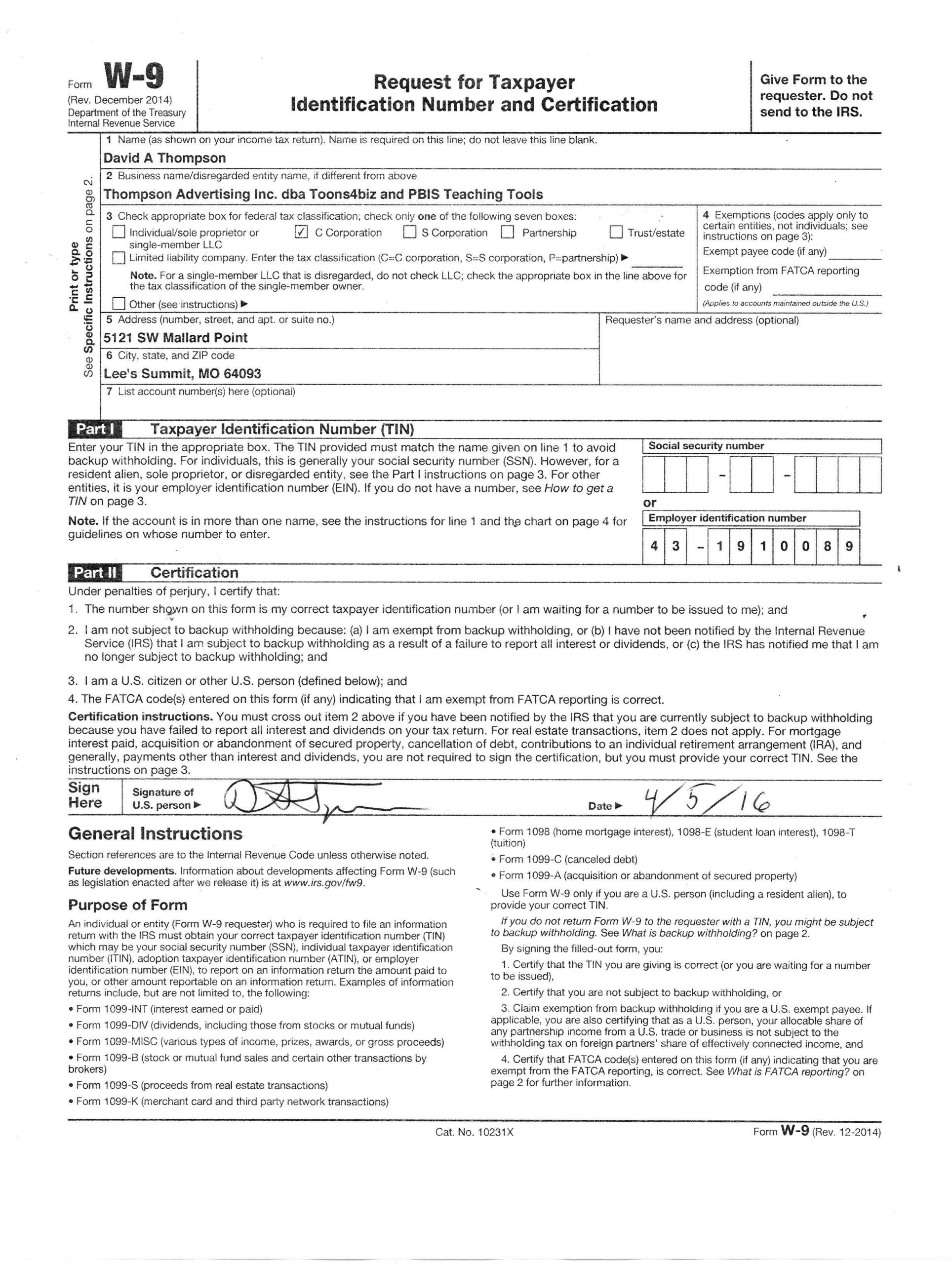

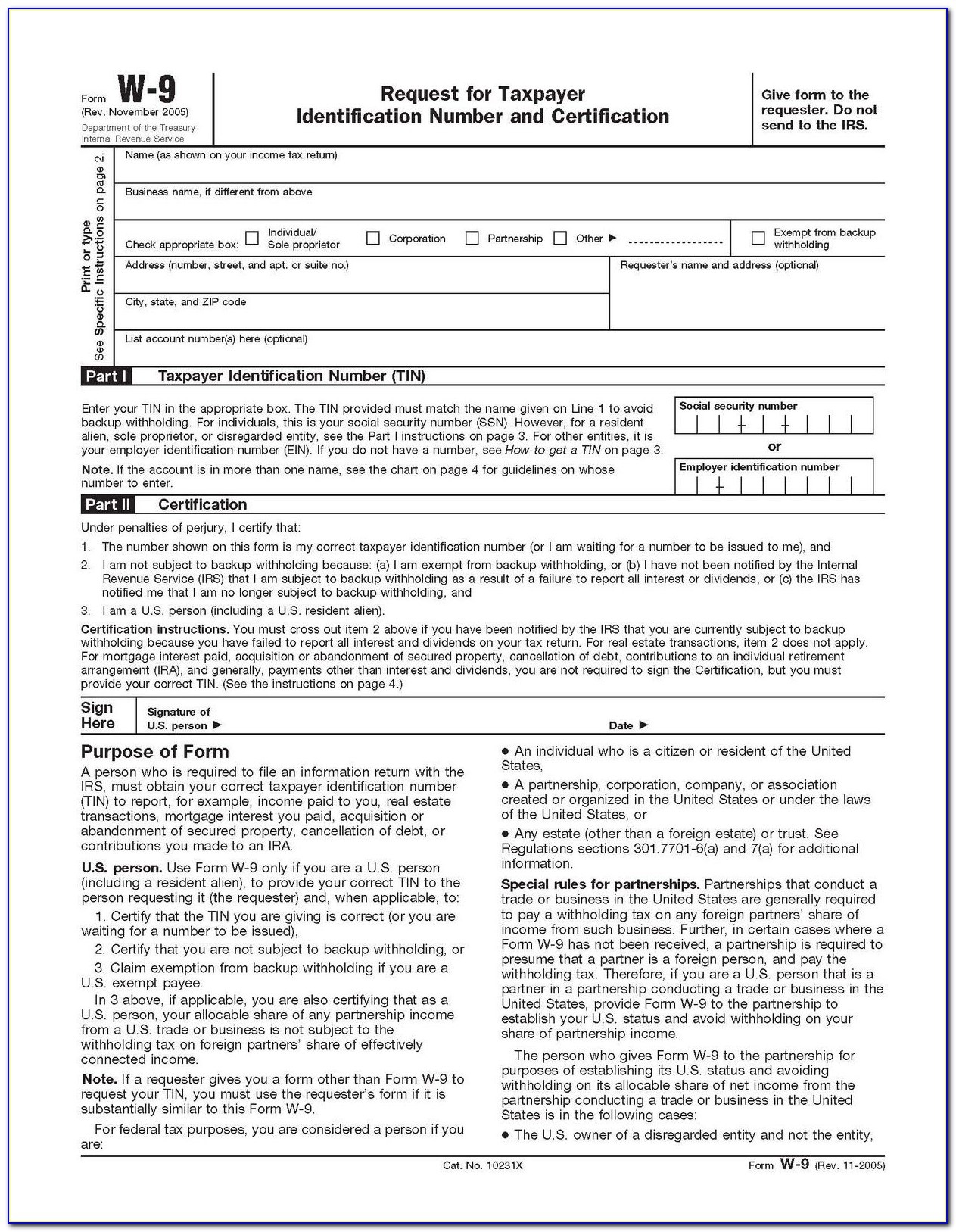

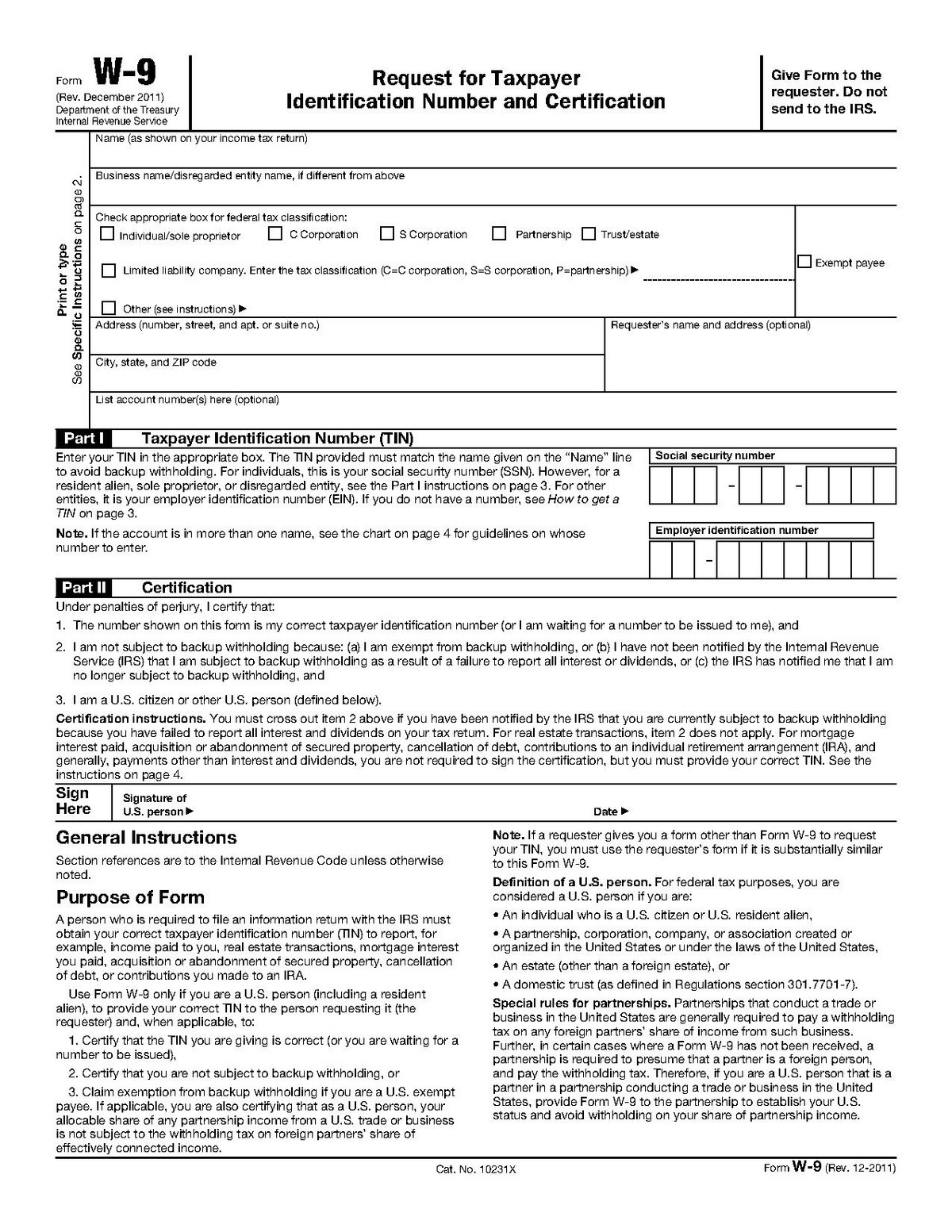

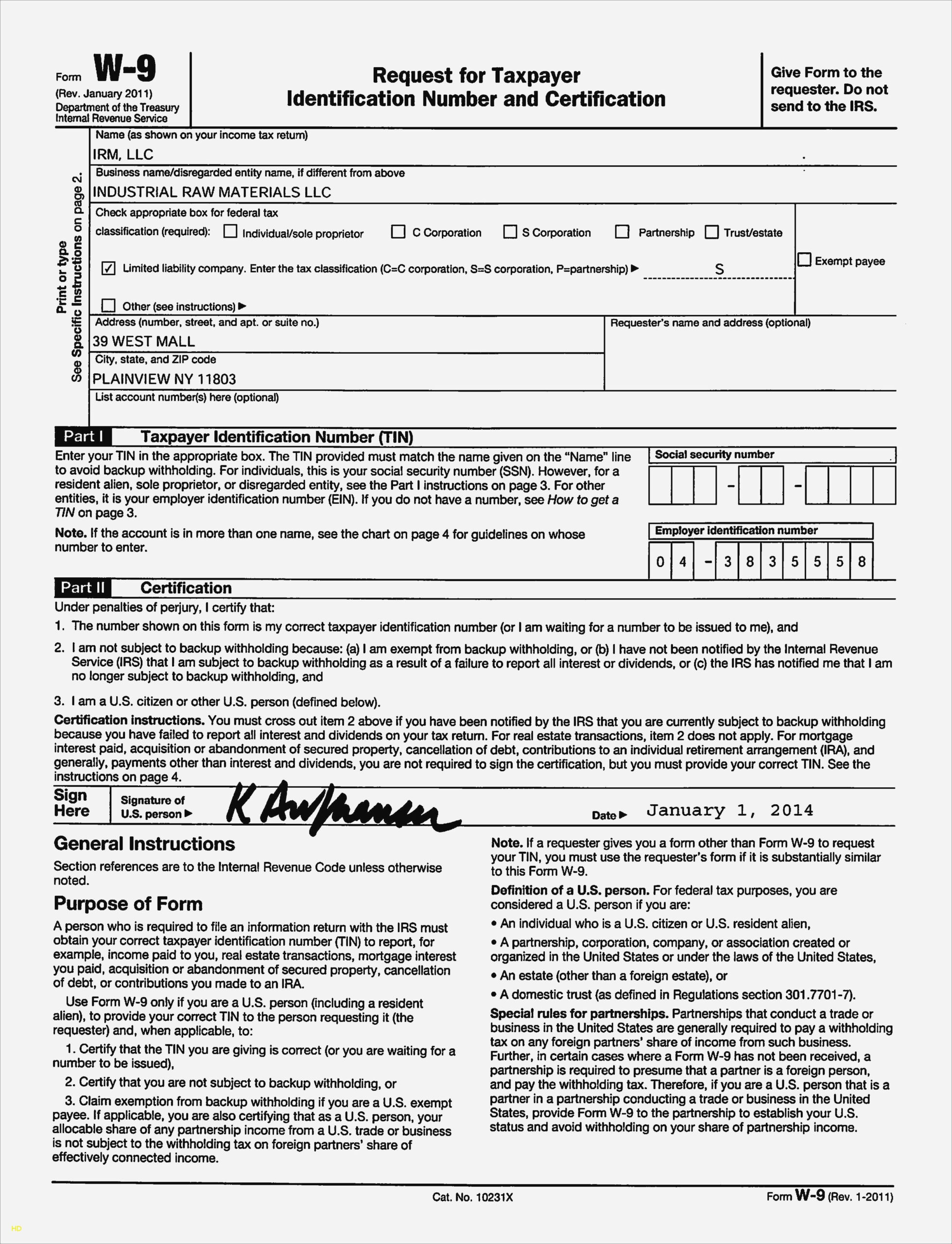

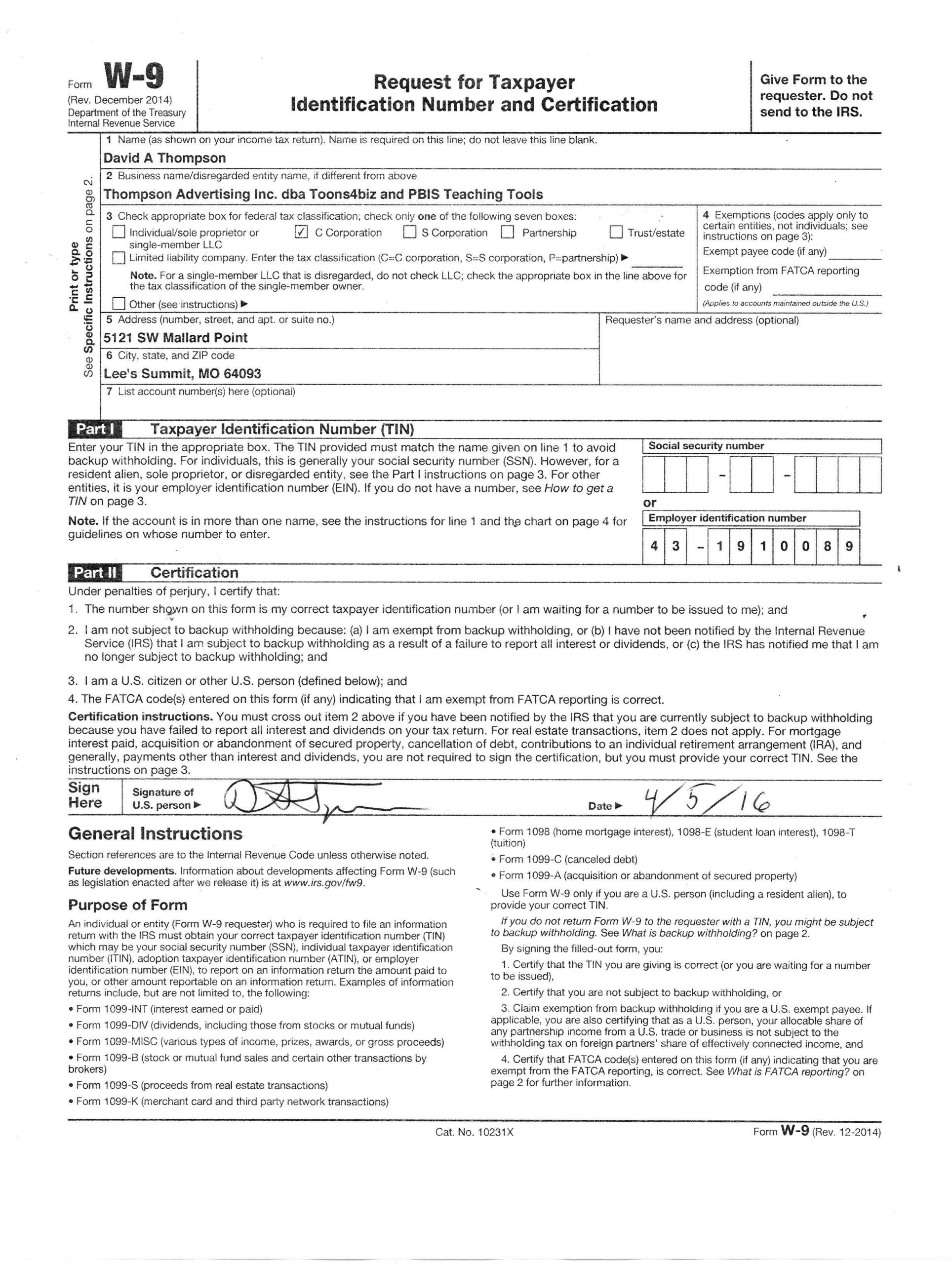

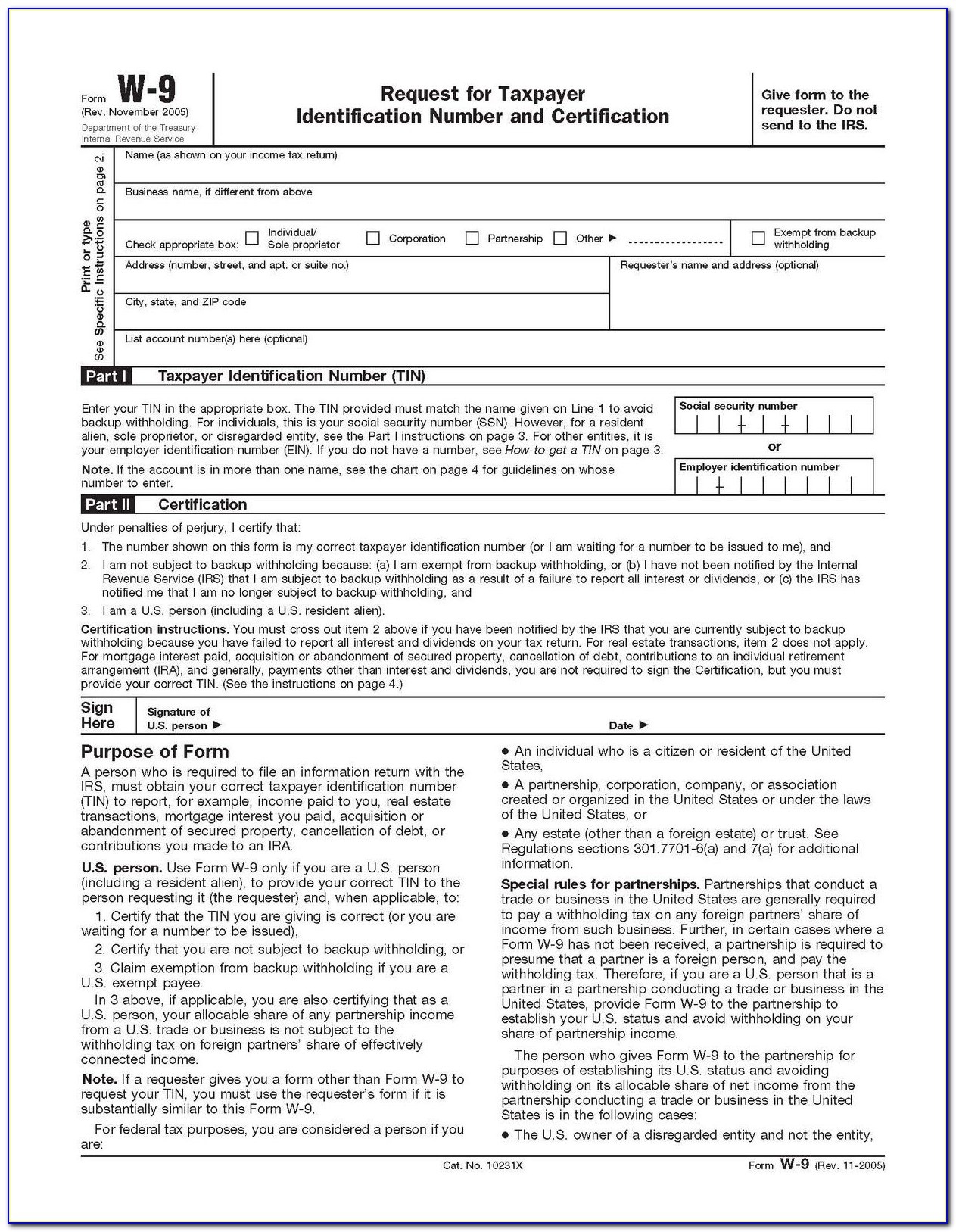

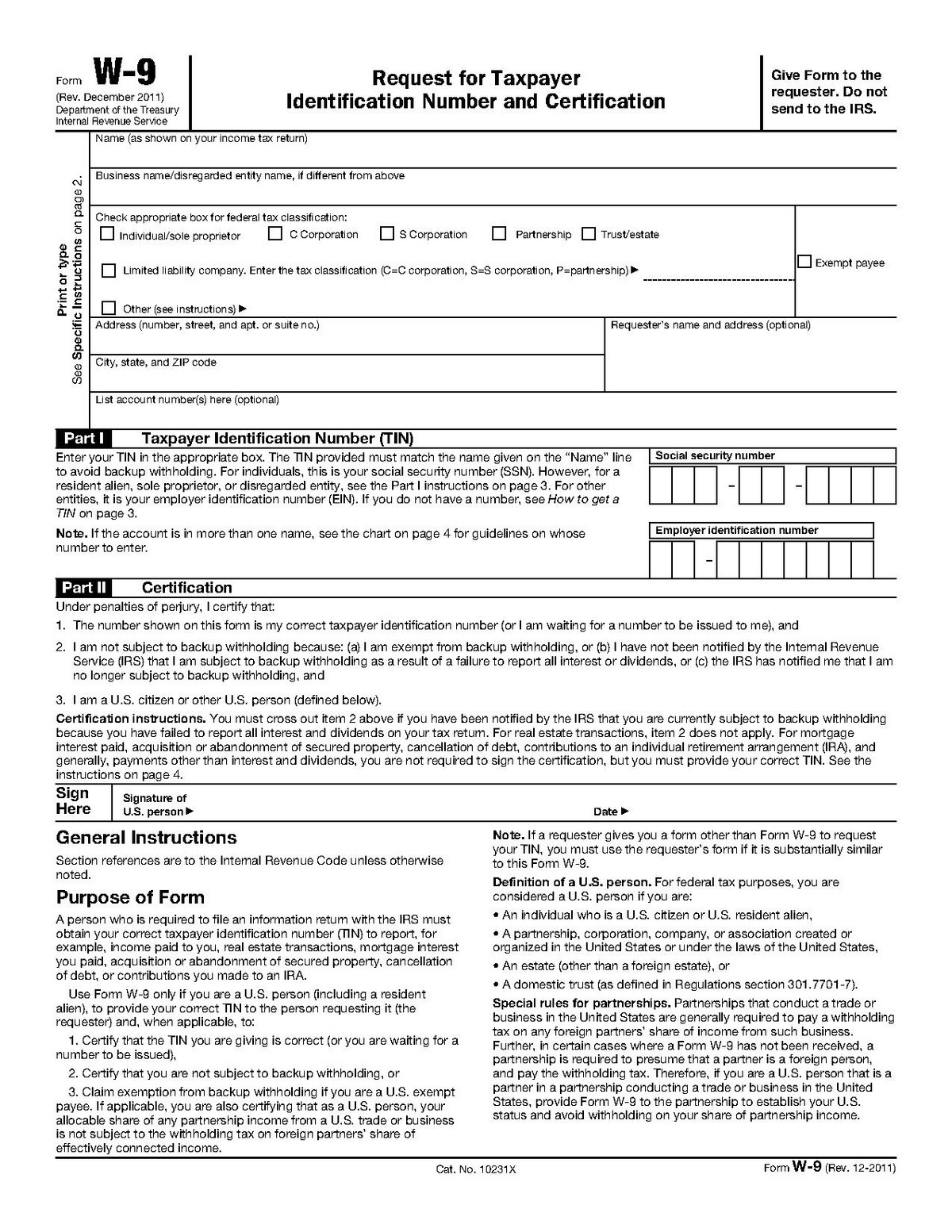

Filling out a W-9 form is relatively straightforward. The form consists of four parts:

Filling out a W-9 form is relatively straightforward. The form consists of four parts:

- Personal Information: This section requires your name, business name (if applicable), and address.

- Tax Classification: Here, you need to indicate whether you are an individual/sole proprietor, a single-member LLC, a C corporation, an S corporation, a partnership, a trust/estate, or an exempt payee.

- Exemptions: If any of the boxes apply to you, you can claim exemptions from backup withholding.

- Certification and Signature: Lastly, you need to sign and date the form to certify that the information provided is accurate.

Fortunately, the W-9 form can be easily found and downloaded online. There are several reliable sources where you can access a printable version of the form, such as the IRS website or reputable tax-related websites. Make sure to use an up-to-date version to comply with the current regulations.

Fortunately, the W-9 form can be easily found and downloaded online. There are several reliable sources where you can access a printable version of the form, such as the IRS website or reputable tax-related websites. Make sure to use an up-to-date version to comply with the current regulations.

Final Thoughts

Understanding the W-9 form is crucial for anyone who receives income from non-employee sources. By familiarizing yourself with the form and providing accurate information, you can ensure that your tax obligations are met and avoid any potential legal issues. Remember to consult with a tax professional if you have any specific questions or concerns regarding the W-9 form or your tax situation.

Understanding the W-9 form is crucial for anyone who receives income from non-employee sources. By familiarizing yourself with the form and providing accurate information, you can ensure that your tax obligations are met and avoid any potential legal issues. Remember to consult with a tax professional if you have any specific questions or concerns regarding the W-9 form or your tax situation.

Today, let's talk about an essential document in the United States tax system called the W-9 form. This is an important form that is used to collect taxpayer information for tax purposes. Whether you are an independent contractor, freelancer, or receive income from various sources, filling out a W-9 form correctly is crucial to comply with tax regulations. Let's dive into some key details!

The W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is a document that businesses use to gather essential information from taxpayers. It helps in ensuring that the correct taxpayer identification number (TIN) is used for reporting income. This information is later used by both the payer and the Internal Revenue Service (IRS) for tax reporting and verification purposes.

The W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is a document that businesses use to gather essential information from taxpayers. It helps in ensuring that the correct taxpayer identification number (TIN) is used for reporting income. This information is later used by both the payer and the Internal Revenue Service (IRS) for tax reporting and verification purposes.

The W-9 form holds significant importance for both the payer and the recipient of income. For the payer, it ensures that they have accurate information to report the income paid to the recipient. For the recipient, it helps in avoiding any backup withholding and ensures the correct taxpayer information is provided to avoid any issues with the IRS.

The W-9 form holds significant importance for both the payer and the recipient of income. For the payer, it ensures that they have accurate information to report the income paid to the recipient. For the recipient, it helps in avoiding any backup withholding and ensures the correct taxpayer information is provided to avoid any issues with the IRS.

Filling out a W-9 form is a straightforward process. The form usually consists of personal information, tax classification, exemptions, and certification sections. You need to provide accurate details such as your name, address, TIN, and tax classification. Ensure that you carefully review the form to avoid any errors. Once completed, sign and date the form to certify its accuracy.

Filling out a W-9 form is a straightforward process. The form usually consists of personal information, tax classification, exemptions, and certification sections. You need to provide accurate details such as your name, address, TIN, and tax classification. Ensure that you carefully review the form to avoid any errors. Once completed, sign and date the form to certify its accuracy.

Obtaining a W-9 form is simple. You can find printable versions online on websites such as the IRS website or other reputable tax-related platforms. Make sure to download the latest version to stay updated with any revisions made by the IRS.

Obtaining a W-9 form is simple. You can find printable versions online on websites such as the IRS website or other reputable tax-related platforms. Make sure to download the latest version to stay updated with any revisions made by the IRS.

Final Thoughts

Understanding and submitting a W-9 form accurately is crucial for anyone who receives income from non-employee sources. It ensures that the IRS has the necessary information to track income and ensures compliance with tax regulations. Keep in mind that this form may have specific deadlines, so it’s essential to fill it out in a timely manner. If you have any questions or concerns, consulting with a tax professional is always a wise decision.

Understanding and submitting a W-9 form accurately is crucial for anyone who receives income from non-employee sources. It ensures that the IRS has the necessary information to track income and ensures compliance with tax regulations. Keep in mind that this form may have specific deadlines, so it’s essential to fill it out in a timely manner. If you have any questions or concerns, consulting with a tax professional is always a wise decision.

A W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is a document that businesses use to collect taxpayer information. It is mainly used to report income paid to independent contractors, freelancers, or other non-employees. If you receive income from multiple sources, you may be required to fill out separate W-9 forms for each payer.

A W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is a document that businesses use to collect taxpayer information. It is mainly used to report income paid to independent contractors, freelancers, or other non-employees. If you receive income from multiple sources, you may be required to fill out separate W-9 forms for each payer. The W-9 form is essential for two primary reasons. Firstly, it provides the payer with the necessary information to prepare and submit an accurate 1099-MISC form, which reports the income paid to you. Secondly, it helps the Internal Revenue Service (IRS) to verify the recipient’s taxpayer identification number (TIN) and prevent fraud.

The W-9 form is essential for two primary reasons. Firstly, it provides the payer with the necessary information to prepare and submit an accurate 1099-MISC form, which reports the income paid to you. Secondly, it helps the Internal Revenue Service (IRS) to verify the recipient’s taxpayer identification number (TIN) and prevent fraud. Filling out a W-9 form is relatively straightforward. The form consists of four parts:

Filling out a W-9 form is relatively straightforward. The form consists of four parts: Fortunately, the W-9 form can be easily found and downloaded online. There are several reliable sources where you can access a printable version of the form, such as the IRS website or reputable tax-related websites. Make sure to use an up-to-date version to comply with the current regulations.

Fortunately, the W-9 form can be easily found and downloaded online. There are several reliable sources where you can access a printable version of the form, such as the IRS website or reputable tax-related websites. Make sure to use an up-to-date version to comply with the current regulations. Understanding the W-9 form is crucial for anyone who receives income from non-employee sources. By familiarizing yourself with the form and providing accurate information, you can ensure that your tax obligations are met and avoid any potential legal issues. Remember to consult with a tax professional if you have any specific questions or concerns regarding the W-9 form or your tax situation.

Understanding the W-9 form is crucial for anyone who receives income from non-employee sources. By familiarizing yourself with the form and providing accurate information, you can ensure that your tax obligations are met and avoid any potential legal issues. Remember to consult with a tax professional if you have any specific questions or concerns regarding the W-9 form or your tax situation. The W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is a document that businesses use to gather essential information from taxpayers. It helps in ensuring that the correct taxpayer identification number (TIN) is used for reporting income. This information is later used by both the payer and the Internal Revenue Service (IRS) for tax reporting and verification purposes.

The W-9 form, also known as the “Request for Taxpayer Identification Number and Certification,” is a document that businesses use to gather essential information from taxpayers. It helps in ensuring that the correct taxpayer identification number (TIN) is used for reporting income. This information is later used by both the payer and the Internal Revenue Service (IRS) for tax reporting and verification purposes. The W-9 form holds significant importance for both the payer and the recipient of income. For the payer, it ensures that they have accurate information to report the income paid to the recipient. For the recipient, it helps in avoiding any backup withholding and ensures the correct taxpayer information is provided to avoid any issues with the IRS.

The W-9 form holds significant importance for both the payer and the recipient of income. For the payer, it ensures that they have accurate information to report the income paid to the recipient. For the recipient, it helps in avoiding any backup withholding and ensures the correct taxpayer information is provided to avoid any issues with the IRS. Filling out a W-9 form is a straightforward process. The form usually consists of personal information, tax classification, exemptions, and certification sections. You need to provide accurate details such as your name, address, TIN, and tax classification. Ensure that you carefully review the form to avoid any errors. Once completed, sign and date the form to certify its accuracy.

Filling out a W-9 form is a straightforward process. The form usually consists of personal information, tax classification, exemptions, and certification sections. You need to provide accurate details such as your name, address, TIN, and tax classification. Ensure that you carefully review the form to avoid any errors. Once completed, sign and date the form to certify its accuracy. Understanding and submitting a W-9 form accurately is crucial for anyone who receives income from non-employee sources. It ensures that the IRS has the necessary information to track income and ensures compliance with tax regulations. Keep in mind that this form may have specific deadlines, so it’s essential to fill it out in a timely manner. If you have any questions or concerns, consulting with a tax professional is always a wise decision.

Understanding and submitting a W-9 form accurately is crucial for anyone who receives income from non-employee sources. It ensures that the IRS has the necessary information to track income and ensures compliance with tax regulations. Keep in mind that this form may have specific deadlines, so it’s essential to fill it out in a timely manner. If you have any questions or concerns, consulting with a tax professional is always a wise decision.